Comprehending Livestock Risk Security (LRP) Insurance Coverage: A Comprehensive Guide

Navigating the realm of animals risk defense (LRP) insurance coverage can be an intricate endeavor for many in the agricultural industry. This type of insurance policy uses a safeguard versus market changes and unexpected situations that can influence livestock producers. By recognizing the details of LRP insurance, producers can make informed choices that may safeguard their operations from monetary dangers. From just how LRP insurance coverage operates to the numerous coverage alternatives readily available, there is much to reveal in this thorough guide that could potentially form the means livestock manufacturers approach risk monitoring in their organizations.

Exactly How LRP Insurance Works

Sometimes, understanding the technicians of Animals Danger Protection (LRP) insurance can be complicated, yet damaging down exactly how it works can provide clearness for farmers and herdsmans. LRP insurance policy is a threat administration device made to shield animals producers versus unanticipated rate declines. The policy enables manufacturers to establish an insurance coverage degree based upon their specific requirements, picking the variety of head, weight array, and protection price. As soon as the plan remains in place, if market prices drop listed below the insurance coverage rate, manufacturers can file a claim for the difference. It is very important to keep in mind that LRP insurance is not an earnings guarantee; rather, it focuses only on price danger security. The protection period normally varies from 13 to 52 weeks, giving versatility for manufacturers to select a period that lines up with their production cycle. By making use of LRP insurance policy, farmers and herdsmans can reduce the financial dangers related to varying market rates, ensuring better security in their procedures.

Qualification and Coverage Options

When it pertains to insurance coverage choices, LRP insurance offers manufacturers the adaptability to select the coverage level, insurance coverage duration, and recommendations that ideal suit their threat administration requirements. Protection levels commonly range from 70% to 100% of the anticipated finishing worth of the insured animals. Producers can likewise pick protection durations that straighten with their manufacturing cycle, whether they are insuring feeder cattle, fed livestock, swine, or lamb. Recommendations such as rate risk security can better tailor coverage to safeguard against damaging market variations. By understanding the eligibility requirements and protection options available, animals manufacturers can make educated decisions to take care of threat efficiently.

Pros and Disadvantages of LRP Insurance

When assessing Animals Danger Protection (LRP) insurance policy, it is necessary for livestock producers to consider the advantages and drawbacks fundamental in this danger administration device.

One of the key advantages of LRP insurance is its ability to give security against a decrease in animals prices. Additionally, LRP insurance coverage supplies a level of adaptability, allowing manufacturers to customize protection levels and plan durations to suit their details requirements.

Nevertheless, there are also some drawbacks to consider. One restriction of LRP insurance policy is that it does not shield versus all types of risks, such as illness outbreaks or all-natural catastrophes. Moreover, costs can in some cases be expensive, particularly for producers with big livestock herds. It is essential for producers to meticulously examine their specific threat direct exposure and monetary situation to figure out if LRP insurance is the appropriate risk management tool for their operation.

Recognizing LRP Insurance Coverage Premiums

Tips for Taking Full Advantage Of LRP Advantages

Making the most of the advantages of Livestock Risk Protection (LRP) insurance requires critical preparation and linked here aggressive threat monitoring - Bagley Risk Management. To maximize your LRP coverage, think about the complying with ideas:

On A Regular Basis Evaluate Market Problems: Remain educated about market patterns and rate fluctuations in the animals sector. By checking these aspects, you can make enlightened decisions about when to purchase LRP coverage to shield versus possible losses.

Establish Realistic Insurance Coverage Degrees: When picking protection degrees, consider your production prices, market price of livestock, and possible threats - Bagley Risk Management. Establishing realistic coverage degrees makes certain that you are appropriately shielded without paying too much for unnecessary insurance policy

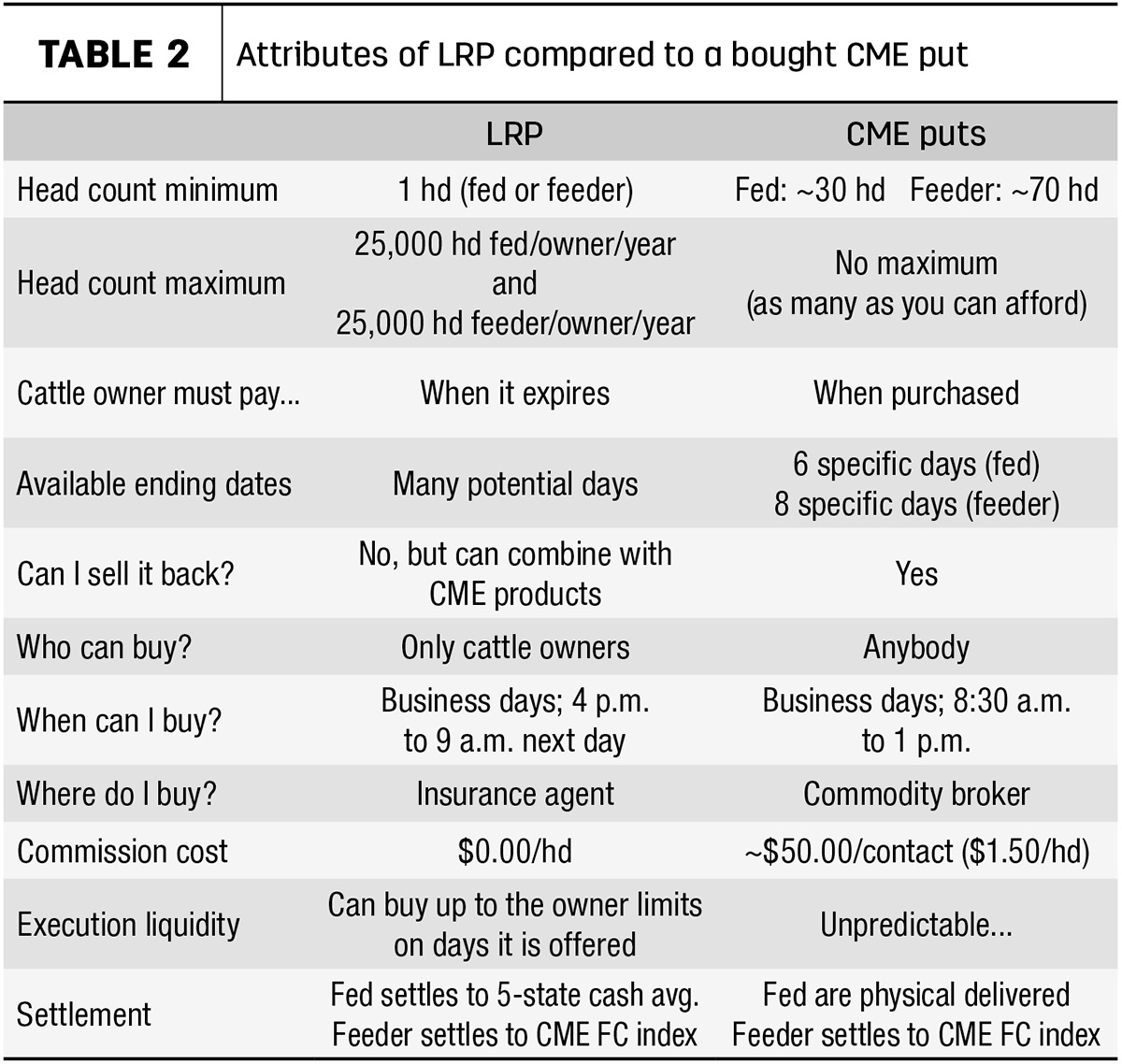

Expand Your Protection: As opposed to depending solely on LRP insurance, consider expanding your threat administration methods. Integrating LRP with various other threat administration tools such as futures agreements or choices can supply extensive coverage versus market uncertainties.

Review and Readjust Insurance Coverage On a regular basis: As market conditions change, occasionally assess your LRP protection to guarantee it lines up with your existing risk direct exposure. Changing click here now insurance coverage degrees and timing of purchases can assist maximize your danger security strategy. By adhering to these suggestions, you can maximize the benefits of LRP insurance coverage and guard your animals operation versus unforeseen threats.

Final Thought

Finally, animals risk defense (LRP) insurance is a valuable device for farmers to take care of the monetary risks connected with their livestock procedures. By understanding just how LRP functions, qualification and insurance coverage options, as well as the advantages and disadvantages of this insurance, farmers can make enlightened decisions to protect their resources. By very carefully thinking about LRP costs and carrying out strategies to maximize benefits, farmers can minimize prospective losses and ensure the sustainability of their procedures.

Livestock manufacturers interested in getting Livestock Threat Security (LRP) insurance policy can discover an array of qualification requirements and coverage options customized to their specific livestock procedures.When it comes to coverage options, LRP insurance policy offers producers the adaptability to pick the insurance coverage degree, insurance coverage duration, and recommendations that ideal match their threat management needs.To understand the ins and click here to find out more outs of Livestock Threat Defense (LRP) insurance coverage fully, recognizing the variables affecting LRP insurance policy costs is crucial. LRP insurance premiums are identified by various components, including the insurance coverage degree selected, the expected cost of livestock at the end of the coverage duration, the type of livestock being guaranteed, and the length of the coverage duration.Evaluation and Adjust Insurance Coverage Routinely: As market problems change, regularly review your LRP insurance coverage to ensure it aligns with your current risk direct exposure.